What Is an Ad Network? Past, Present, and Future

When publishers started moving their media assets online, they initially adopted print media practices for monetizing their ad space. They struck direct deals with advertisers for blocks of ads. However, they soon acknowledged that the existing model couldn’t scale, and a lot of inventory remained unsold.

Moreover, advancement in data collection and management made digital advertising a radically new landscape. Advertisers collect immense data on their users, track them across different environments, and are interested in buying traffic rather than bundles of ads. The industry craved a new technological solution that would optimize media buying and make it truly data-driven. An ad network became this solution.

- What is an ad network?

- How was an ad network invented?

- Difference between an ad network and ad server

- Two main types of ad servers

- Differences between an ad network and SSP

- How do ad networks work?

- Evolution of ad networks

- Rise of horizontal ad networks

- Future of ad networks

- The comeback of vertical ad networks

- Solutions to the identity problem

- 1. Single Sign-on

- 2. Data Pools

- 3. User Graphs

- To sum up

What is an ad network?

An advertising network is a company that brokers the deals between publishers and advertisers.

The introduction of ad networks resolved critical scaling problems of digital advertising. The ad network represents multiple media owners in the advertising marketplace, groups their inventory, and sells it programmatically (usually through auctions). It eliminated redundant processes of manual insertion orders and face-to-face negotiations.

Advertising networks collect ad inventory from supply sources – web publishers, apps, streaming platforms, etc. – and match them with advertisers looking for appropriate audiences.

An ad network is a commercial intermediary, in charge of monetization for the supply side, and offering the most effective ad placements for the demand side.

Creating an ad network requires sufficient labor and time. Yet, it could be simplified with the right tech solution. For instance, Admixer offers white-label Admixer.Network, an all-in-one platform for the creation and management of ad networks.

How was an ad network invented?

First, ad networks emerged in the mid-90s with the maturing of digital advertising. The dot.com bubble caused a rapid increase in the number of digital publishers.

The demand for digital advertising was also vast. Still, due to the fragmented nature of the supply, advertisers often couldn’t find appropriate audiences, and publishers couldn’t sell all of its inventory. The supply couldn’t meet the demand, due to the lack of proper infrastructure.

Ad networks ironed out those inefficiencies out of the market, and represented publishers and facilitated the process.

Initially, ad networks collected the traffic that remained unsold after direct deals. This inventory was usually sold at a much lower price than ad space in direct sales. Ad networks were perceived as a way to sell remnant, non-premium traffic.

Difference between an ad network and ad server

The ad network is not the only prerequisite for placing and displaying digital ads. Ad serving relies on the whole array of ad tech products, and it’s crucial to tell them apart.

The main purpose of an advertising network is to assist publishers in their monetization efforts, control fill rate, optimize yield, and transact media buys. Like managing advertising campaigns and reporting on the results, all other essential functions are done through the ad server.

Two main types of ad servers

- first-party ad server, used by publishers,

- third-party ad servers, used by advertisers.

The first-party ad server, such as Admixer.Publisher, allows publishers to deploy ad spaces on their website, sell ads via direct deals or header bidding, transfer the remnant traffic to the ad exchanges, and report on the ads’ performance.

With ad servers, publishers connect to advertisers via ad tags and sell their inventory via waterfalling. They have to set up campaigns and upload creatives manually. An ad server provides limited options for trading inventory programmatically, uploading and monetizing data, connecting own programmatic demand. To streamline most of these processes, publishers need advanced functionality of Admixer.Network.

The third-party ad server allows advertisers to run campaigns. It stores the ad creatives, helps to measure campaign performance, and reports on campaign results.

Differences between an ad network and SSP

Both SSP and ad networks collect publisher inventory to sell it to advertisers, so those adtech platforms are quite similar on the surface level.

Historically, ad networks relied on the waterfalling, also known as daisy-chaining or waterfall tags, a way of selling publishers’ assets sequentially, invoking one demand source at a time. SSP was the next step in the programmatic evolution and offered publishers to sell their inventory via open RTB auctions.

Advertisers needed audiences across various geo locations and content niches, while most networks had limited scope. Ad networks had different integration methods and issues with inventory sales to external sources, many optimization tasks were done manually.

The arrival of SSPs with openRTB auctions allowed advertisers to access global inventory, achieve an international scale, and streamline the media buying. The ad network model persisted in the niches that are not ready for programmatic adoption.

For instance, adult content is blacklisted by most SSPs, and is still monetized their inventory through old-fashioned ad networks and waterfalls.

Other ad networks concentrated on providing premium inventory, and striking deals with direct advertisers. Modern ad networks evolved and adopted programmatic technologies, most frequently header bidding. For this reason, nowadays, the distinction between SSP and ad network is blurred, and many companies use those terms interchangeably.

How do ad networks work?

- Ad network gathers a large number of publishers to offer their inventory to advertisers. Ad networks can concentrate on a particular format, like a mobile ad network or rich media ad network, focusing on premium inventory or certain geo.

- Publishers install the ad network ad tags on their site by inserting them directly into the page or using a first-party ad server.

- Ad networks ensure the demand of the ad inventory and monetization of publishers’ assets by connecting a large number of advertisers, big brands, agencies, or small businesses.

- Advertisers can launch their ads and promotions through an ad network campaign-management panels. They can also deploy a pixel from the third-party ad server, in case they are running campaigns in multiple networks, to get aggregate data from all environments.

- Publishers send a bid request with information on the impression, user data, the ad placement format, and the bid floor (the minimum amount they want to get for the impression).

- The advertiser sets up the campaign parameters in their bid response (such as targeting, budget, frequency caps, etc.). Then, ad networks match the appropriate bid response with the bid request, either through the auction or daisy-chaining.

- When the ad is published, the advertiser can launch multiple banners on the website using the ad network’s campaign-management panel without having to contact the publisher.

Evolution of ad networks

Nowadays, the supply chain of ad impressions is much more complicated, and the role of an ad network may vary significantly.

Instead of selling the remnant traffic, many ad networks took a strategic approach and concentrated on getting premium inventory and offering it to advertisers for higher prices. They cherry-pick a narrow segment of the audience from the esteemed publishers and resell it at a premium price.

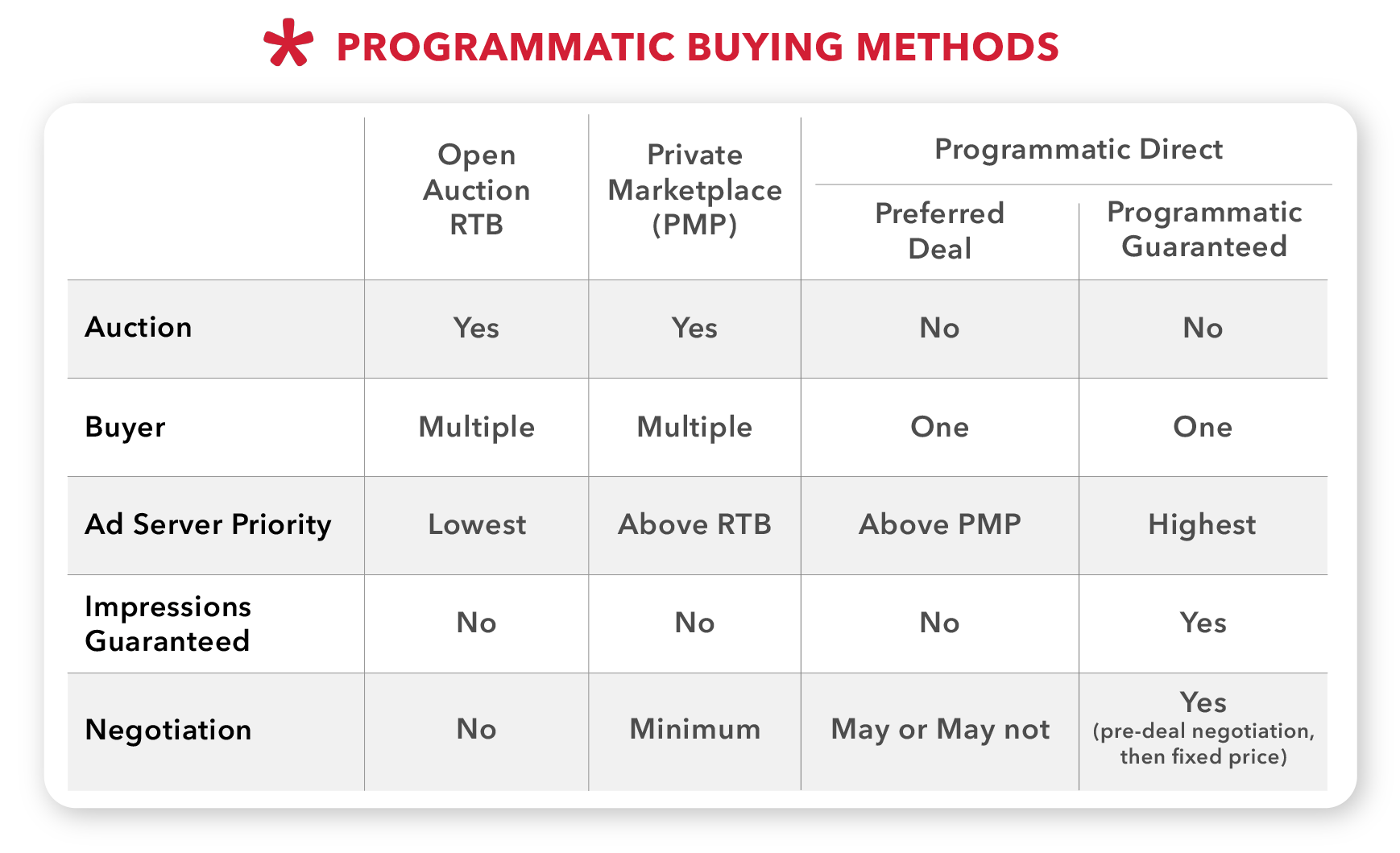

Ad networks started utilizing advanced programmatic trading methods, such as private marketplaces and preferred deals, to offer inventory to selected groups of advertisers on special conditions before entering the open auction.

Some networks concentrated on the niche inventory, giving rise to video ad networks, native ad networks, rich media ad networks, etc. Others preferred to diversify, to provide the full spectrum of ad placements. Certain ad networks buy inventory from SSPs or ad exchanges to meet its demand partners’ needs, while others exclusively sell the inventory of its own publishers.

For instance, the New York Times has its own ad network– a self-service platform for small advertisers with less than $10,000 to complement its direct deals department.

Rise of horizontal ad networks

Between 2001 and 2010, most ad networks concentrated on particular verticals, accumulating ad spaces in certain content categories, such as travel, finance, automotive, luxury goods, parenthood, etc. Vertical ad networks were considered a path forward for the industry.

However, the adoption of real-time bidding in 2010, which required sophisticated setup and a lot of processing power, shifted the funding to the horizontal ad networks, which served multiple verticals and industries. Those advertising networks sold similar data sets, technology, and media spaces, etc. both to FMCG and automotive industries.

The introduction of audience targeting allowed showing the right ad to the right user even on the unrelated content category’s website. Independent horizontal ad networks consolidated, in the wake of Google and Facebook expansion, while vertical ad networks mostly left the stage.

Future of ad networks

The wave of privacy regulations and the phase-out of advertising IDs (elimination of 3rd party cookies in web browsers, IDFA opt-in on iOS) will soon render a lot of programmatic capabilities obsolete.

Digital advertising will quickly have two distinct environments: authenticated audience and anonymous audience. Advertising to the first group will rely extensively on the logged-in data or identity solutions still under development. Advertising to the second group is problematic and might bring back to life vertical ad networks.

The comeback of vertical ad networks

Scaled buying and advertising to the unidentified users will be possible only through contextual campaigns. This may lead to the resurgence of vertical ad networks, which can gather highly contextually-rich publishers.

Moreover, horizontal ad networks frequently offer one-size-fits-all solutions, which can be counterproductive for some sensitive product categories, such as healthcare, education, and real estate.

Horizontal advertising networks are indispensable when promoting low-cost and low-consideration products.

But the situation is drastically different for products that are expensive and can be considered for months and years. Winning over those customers is different than getting a lot of impressions or clicks. A vertical ad network, which is designed for a single industry, can be more effective here.

Solutions to the identity problem

We considered possible advertising solutions for the anonymous web. Let’s review identity solutions that can replace advertiser IDs and resolve the critical problem with establishing user identity for further re-targeting:

1. Single Sign-on

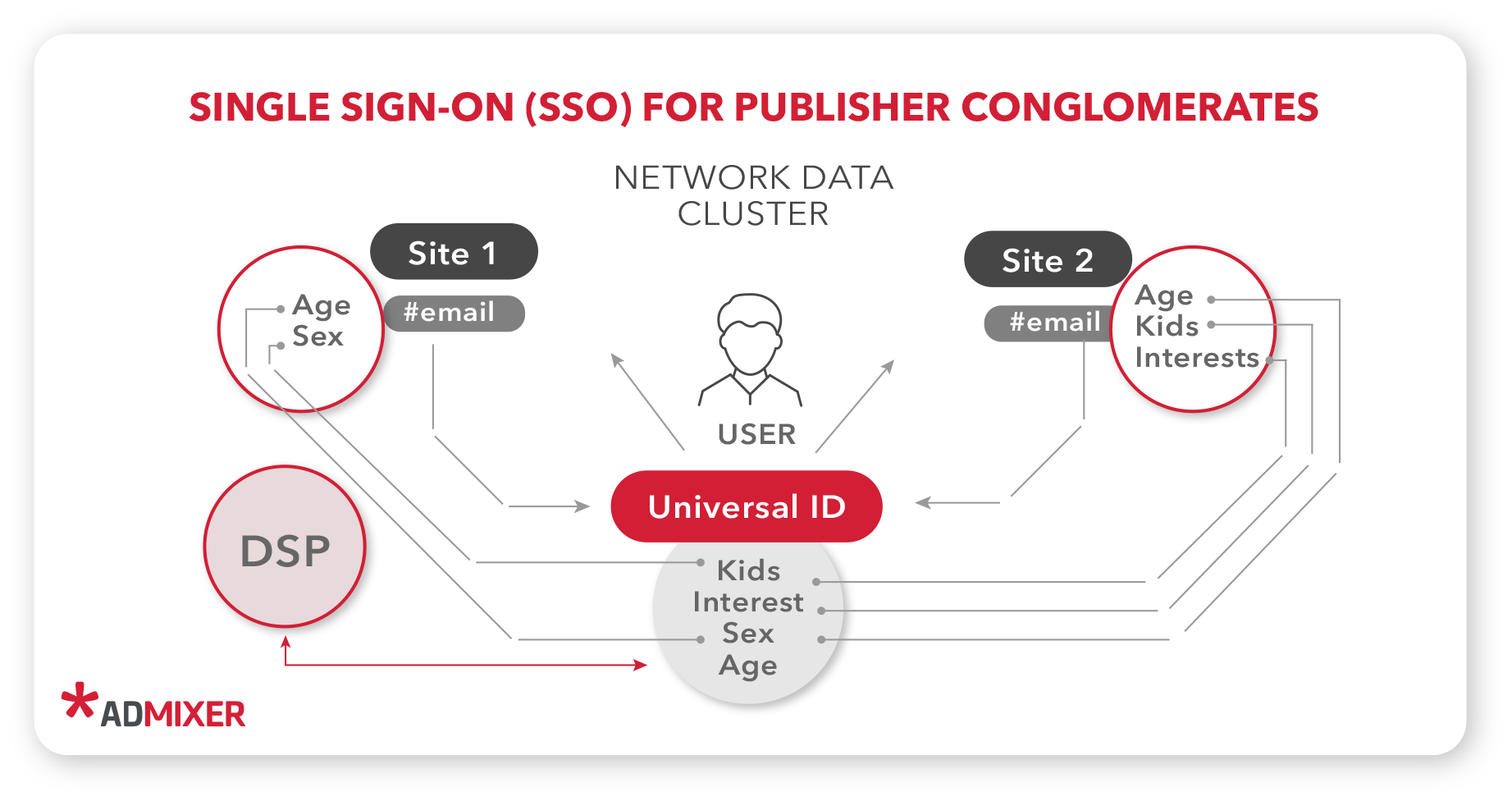

Single Sign-On (SSO) is a technology that gives users access to multiple resources without re-authentication.

The unified ID is a common identifier used by different platforms on top of other IDs. With a single sign-on, there is no need for additional cookie-matching.

This technology aims to identify users cross-site, similar to 3P cookies but using different identifiers.

In Unified IDs, two identifiers will work in conjunction:

- 1st-party website cookies,

- Permanent user identifiers, such as email (hashed) and phone number (hashed).

Premium ad networks that maintain close-partnerships with publishers, or ad networks of media holdings with multiple publishers and owned media, are ideally positioned to implement the single sign-on solution across their media assets. This way, they can generate 1st party data and provide targeted audiences across their inventory.

2. Data Pools

It’s an independent data storage, where publishers could upload their 1st-party data from one side, and advertisers do the same thing.

With this technology, advertisers get a deeper understanding of their customers from the publisher’s resources and can activate the audience with publishers data. The solutions comply with existing privacy regulations.

Ad networks direct relationships with publishers, make it a great intermediary between publishers and advertisers in setting up data pools.

3. User Graphs

This solution binds together different identifiers, both PII (like emails, phones, physical addresses) and non-PII (like cookies, MAIDs, and pubIDs).

The main advantage is that ad networks can provide their audiences for activation across different channels through user graphs and connect users’ activities in different environments.

If you want to create your own ad network, you should consider the White Label Platform. It is a comprehensive solution, that allows you to easily build an ad network and connect it to reliable programmatic monetization sources.

We’ve previously described how to choose the right tech partner to create an ad network.

To sum up

Ad networks were initially developed as a way of selling remnant inventory after the most valued placements were sold via direct deals. Ad networks resolved the problem by automating media trading and significantly reducing the time on face-to-face negotiations.

However, due to the nature of their media trading method- waterfalling, ad networks were not able to ensure diverse demand, could only provide fragmented audiences to advertisers, and had issues with external integrations.

The introduction of SSPs resolved innate problems of ad networks, with the adoption of open RTB – first truly programmatic trading methods. This development caused consolidation on the market since openRTB technologies require a complex and time-consuming setup. Instead of many vertically integrated ad networks concentrated on a particular content niche or industry, we got a few horizontal SSPs.

Nowadays, the difference between ad networks and SSPs is blurred. Entities that still call themselves ad networks, usually concentrate on the premium inventory, sell owned media, or are dedicated to a particular content format or narrow audience.