IDFA Opt-In: How Apple Privacy Updates Will Reshape the App Economy

On June 22, during WWDC 2020, Apple announced several privacy-related updates that will take effect later this year. The wave of privacy concerns pressured digital advertising to rethink its approach to the use of 3rd-party identifiers. Thus, Apple announced major restrictions to the work of IDFA – its ID for the in-app environment on IOS devices, an equivalent of 3rd-party cookies on the web.

The changes will come in effect with iOS 14 release in mid-September and will significantly limit IDFA functionality, disrupting established methods of audience planning, targeting, attribution, and performance measurement. If IDFA is soon to be dead, what can advertisers and app developers do to mitigate risks?

IDFA opt-in

IDFA is a tool that advertisers use to track users’ activities across the iOS application ecosystem and attribute app installs and events to advertising activities. Currently, installing an app implies consent to using IDFA for tracking and targeting purposes of all applications on the users’ device.

In iOS 14, all apps will need to request consent to use IDFA for tracking.

When the user upgrades to IOS 14, the IDFA instantly stops being available on all user apps. Once the user launches one of the apps, they will receive a request to allow the app to use IDFA again, the so-called opt-in message. If the user skips or denies the request, the application is not allowed to solicit it again.

In case the user ever decides to opt-in, they will have to do go deep in the settings. There is no universal opt-in, and each app will have to go through the process individually.

Consequences for app developers

The removal of the advertising ID is always bad news for a publisher, undermining the entire ad-supported business model. The elimination of third-party identifiers cripples segmentation, ad targeting, attribution, and measurement, resulting in an average of 52% decrease in advertising revenue.

Mobile marketing experts project that only around 20% of users will choose to opt-in when presented with a menacing pop-up. More optimistic forecasts expect the opt-in rate to be around 65%. Publishers will be able to offer much fewer addressable impressions, which will affect their advertising revenues.

According to Tetiana Sichko, Business Development Manager at Admixer, the update may alter monetization models:

“The elimination of ad IDs depresses CPMs and forces the ad market to transition to CPC / CPI models, which will reflect positively on the performance campaigns. App developers would have to be more diligent in their own user acquisition strategies, more responsible in their anti-fraud policies, as well as more inventive in revenue generation methods.”

Demand partners, DSPs, and ad exchanges rely on device identifiers to value ad inventory. A top-level corporate executive or a teenager can view the ad in the hyper-casual game. As a result, ad placements have different values and different markups, but without appropriate ID, advertisers could never tell.

App developers need to invent new ways to motivate customers to opt-in while implementing sufficient privacy measures.

Consequences for advertisers

The new IDFA restrictions will make the life of advertisers significantly harder. By the most conservative estimates, the number of targeted impressions will drop to 50%.

Advertisers will no longer have access to narrow segments of the audience and deterministic 1-to-1 targeting. They will lose the toolkit for granular reporting and instead will have to rely on very broad categorization.

Ivan Fedorov, New Business Director at Admixer, points out the implications of the new privacy update:

“This change will crash the existing advertisers’ segmentation and retention scenarios. Most of the brands have well-structured user bases and well-tested approaches to user’s re-engagement, not to mention AI-based optimization models for ROAS and LTV. With the IDFA deprecation, these approaches will lose their relevance, and most of the client base could become unusable for remarketing mechanics.”

Without the advertising ID, marketers won’t be able to set effective retargeting campaigns or cap frequency. Advertisers can still retarget users based on non-IDFA data such as email addresses or phone numbers, but very few apps collect this kind of information.

Consequences for the app industry

Michael Sweeney, Head of Marketing at Clearcode, explained how the upcoming changes will shape programmatic advertising

“The privacy changes in the in-app mobile and web browser environments are moving programmatic advertising away from 1-to-1 identification towards more privacy-friendly alternatives. The real challenge for app developers, AdTech companies, and advertisers is to continue delivering effective advertising (audience targeting, accurate attribution, etc.) but with a stronger focus on privacy. Unfortunately, this is easier said than done.”

SDKs

IDFA is a cornerstone of mobile marketing technologies that measure campaigns, find new app users, and segment audiences. The IDFA opt-out will render many of these tools useless. For instance, Facebook SDK will no longer deliver App Event Optimization (AEO) and Value Optimization (VO), with the same precision:

- AEO – deliver ads to people who are more likely to take valuable actions within their apps

- VO – deliver ads to people who are likely to spend more in-app.

GAID

Google has its own identifier for apps – Google Advertising ID (GAID), which is still active. However, Google and Apple always went hand in hand with their privacy initiatives, and it will be logical if Google follows Apple and makes GAID opt-in as well.

The notable difference between the two identifiers is that GAID has additional features for post-install attribution – Google Play Store Referrer parameter. It can be appended to links and used to map out conversions and attribute the installs. Thus, the possible opt-in for GAID can tarnish the retargeting efforts, but won’t dramatically affect attribution.

IDFV

The looming restrictions in IDFA can lead to consolidation on the app market. There is a specific identifier for vendors – IDFV, an ID for publishers of multiple apps.

App developers can buy out several low-value apps to have a larger footprint of device identifiers (IDFVs) for retargeting users across their apps. As a result, the market can see the rise of app holdings, with extensive libraries of mobile applications or games.

Possible solutions

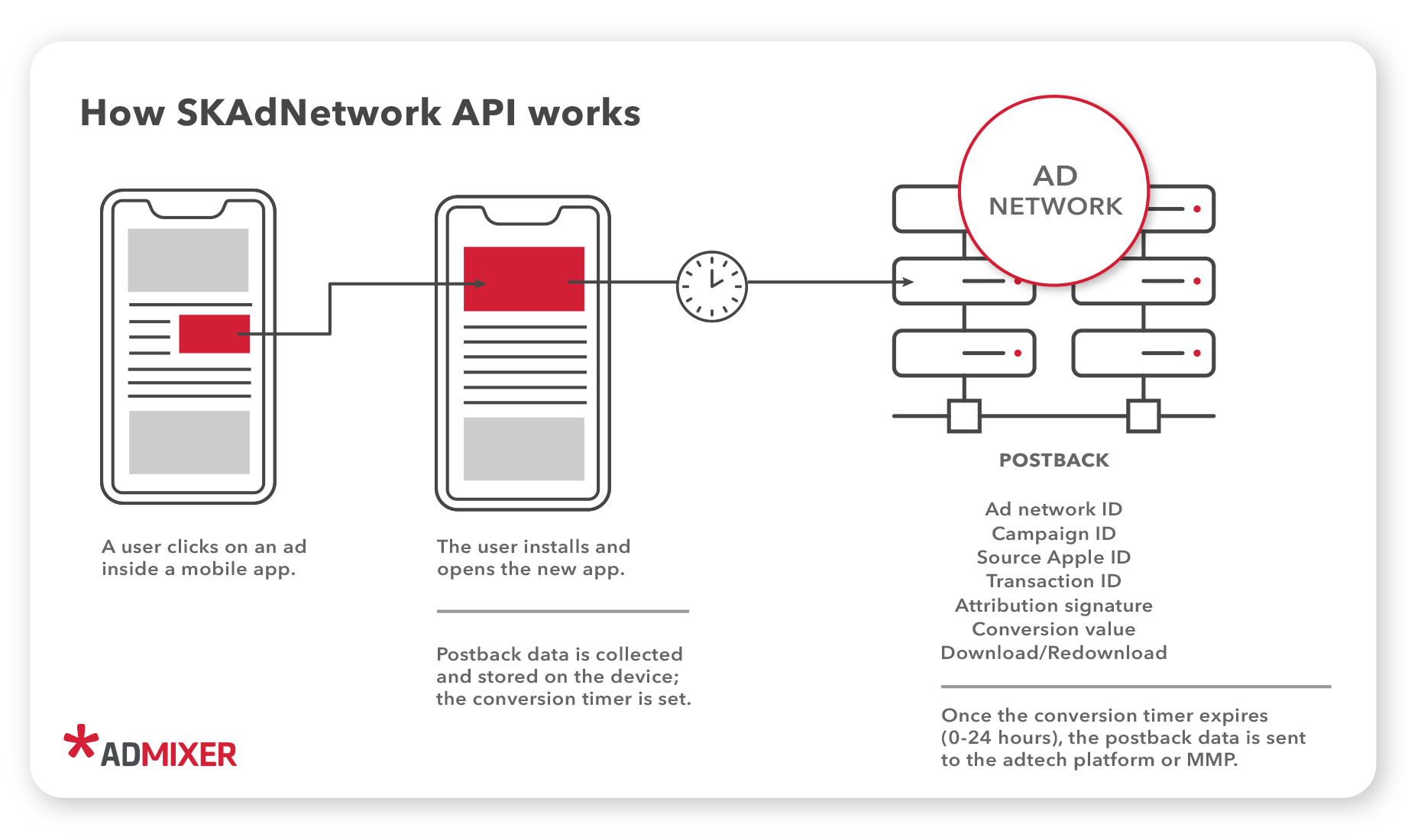

SKAdNetwork

Of course, Apple has not left industry hanging in the air and offered a potential solution – SKAdNetwork. This solution provides conversion information to advertisers without disclosing any device-level or user-level data. SKAdNetwork API receives metadata from ad clicks and sends postbacks about the app installs. In iOS 14, Apple introduced several new parameters to SKAdNetwork that convey data about the source publisher and the conversion event.

Finger tipping

The changes in IDFA might mark the transition from the audience targeting based on the user data to more contextual targeting.

Apps are isolated from other digital marketing environments; for instance, mobile browsers cannot access the IDFA. Thus, marketing measurement companies (MMPs) use a technique called finger tipping to connect the dots and link the web to app conversions.

Finger tipping involves gathering circumstantial mobile device data, like IP addresses, software versions, and device type, to generate a so-called signature to recognize the user probabilistically. The signatures are collected both for ad clicks and app initials and then matched to identify the conversions. In the post-IFDA world, the app’s attribution to app flow can be measured similarly to the web to app flows with finger tipping.

MMPs

Mobile measurement partners, such as Adjust or Appsflyer, are auditors of the mobile advertising industry. They use additional tech solutions to attribute the ad campaign results and link them to ad networks.

Without the deterministic data from the IDFA, multi-touch, and last-touch attribution, the customer journey’s plotting will become increasingly difficult. MMPs are ideally positioned to aggregate install receipts, campaign, and event identifiers, compare them against campaign metrics, and provide probabilistic reporting.

Conclusion

The announced changes to the IDFA signal an entire ecosystem shake-up, which will disrupt existing tracking and attribution models. The industry hasn’t decided on the universal solution yet, the SKAdNetwork is still a work in progress, and market players are actively evaluating other solutions.

Recommendations for app developers

The IDFA opt-out is inevitable, and app developers have to do all the necessary preparations before iOS14 is released.

- First and foremost, app publishers should integrate with SKAdNetwork if they haven’t done so.

- Second, publishers have to put forward opt-in wording for Apple’s one-time display to maintain IDFA usage once iOS14 is present.

Recommendations for advertisers

Advertisers that rely on in-app advertising on iOS need to rethink their approach to data in line with updated privacy regulation, examine their tech stack, MMPs, or be ready for the post-IDFA world.

With less than 50% of the opted-in target audience, it’s difficult to build a sustainable user acquisition strategy and avoid overspending in terms of imprecise capping, incorrect audience targeting, reaching existing clients with the wrong message, etc. It will take some time to elaborate on new ways to scale user acquisition and will require new tools and services to evaluate the effectiveness with no reliance on user advertising IDs.

Advertisers should use the time before the iOS 14 release to test new tracking and attribution models based on the available 3rd-party data to understand customer decision journeys.

Advertisers should enrich data, and establish partnerships with clients, vendors, and big data owners to cross-reference audiences, and add additional identifiers to build user graphs.